Sacyr posted an EBITDA of €143 million in the first quarter of 2019, up 28% compared to the same period last year. Net profit stood at 38 million € between January and March, with an increase of 10%.

The strong growth posted in the first quarter of the year confirms the success of Sacyr's strategy. This strategy places the focus on profitability, financial discipline, consolidation in our strategical markets and business with a clear concessionary profile. Indeed, 77% of EBITDA comes from low demand risk assets.

During the first quarter, Sacyr recorded a significant increase in EBITDA in its business divisions: Concessions (+27%), Engineering and Infrastructure (+40%), Services (+24%).

Furthermore, business profitability, measured by the EBITDA margin, grew from 12.6% in the first half of 2018 to 14.7%.

Turnover growth

Sacyr's turnover was €972 million, up +10% compared to last year. This growth is a result of the success in contracting registered by all business areas during the last financial years.

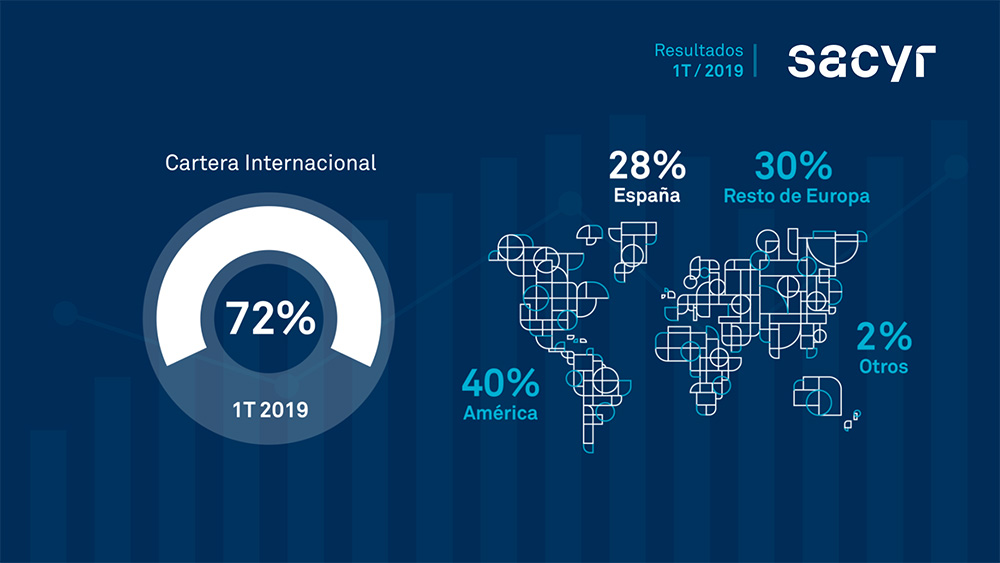

The future income backlog closed the first quarter at 42,912 million euros (+3%). The backlog reflects the strong internationalization of the company: 72% is already located outside Spain. This figure rises to 88% in the case of Engineering and Infrastructure and 82% in the case of Concessions.

During 2019, Sacyr is awarding significant contracts in its strategic markets. This is the case, for example, of the Los Vilos - La Serena highway (Chile), the extension of the Edinburgh tramway (United Kingdom), two sections of high-speed railways in Spain and Portugal and the new terminal of the Tenerife Airport.

Financial debt

The group's net debt stood at €4,177 million at the end of the first quarter, with a slight increase compared to the end of 2018 (€4,045 million). The net recourse debt, of €1,124 million, is reduced compared to the 1,138 million at the end of last financial year.

Sacyr disinvested its stake in Itínere Infraestructuras in the first quarter, for which it obtained a total of €202 million. Furthermore, after March, it completed the rotation of 49% of seven Chilean assets for a total amount of €440 million.

During the first quarter, the company completed the return of the advances to the Panama Canal Authority.

The company keeps a regular shareholder compensation policy. Last February it paid the dividend on account of the 2018 results through a scrip dividend: one share for each 35 or €0.051 per right. 95% of the capital chose to receive shares, which proves investor confidence in the stock.

Change by business area

Concessions.- Sacyr Concessions posted a turnover of €218 million, up 51% compared to that of the first quarter of 2018.

Of the total, €117 million came from concession revenues, which grew 22% as a result of assets operation growth, the start of Tepual airport (Chile) operations and the improvement in highway traffic figures. The remaining 101 million (+108%) come from construction revenues, which are growing strongly due to the execution of projects in Colombia, Chile and Mexico.

EBITDA reached €75 million, up 27%.

The backlog of future revenue reached €28.064 million (+4%), with its international business accounting for 82% of this figure.

During the first quarter, Sacyr was awarded two major projects in Chile, the Los Vilos-La Serena highway (€864 million) and the Challacuta Airport (€203 million).

Engineering and Infrastructure.- The turnover of this division reached €456 million, with 14% growth compared to the same period of 2018.

EBITDA increased 40% to €41 million and the EBITDA margin improved to 9%, compared to 7.3% in January-March 2018.

The infrastructure backlog reached €6,554 million, up 6%, and represents 43 months of activity. 88% of the backlog is located outside Spain.

It is worth noting the award of relevant projects in Chile, such as the construction of the Sótero del Rio hospitals (€328 million) and Cordillera Province (€153 million). In addition, Sacyr was awarded the construction of the Évora high-speed line in Portugal (€130 million) and the stretch of AVE Arejos-Níjar in Almería (€98 million). In the UK, the extension of the Edinburgh tramway will be performed (€120 million) and in Tenerife (Spain) the building linking terminals 1 and 2 of Tenerife South Airport (€44 million) will be built.

Services. - The turnover of this division grew by 5%, to €266 million. EBITDA reached €24 million, 24% more compared to 2018, on the back of the contribution from all areas. Environment (+15%), Multiservices (+98%) and Water (+20%). The EBITDA margin grows and is up from 7.7% to 9%.

The Services backlog totaled €5,836 million, similar to the figure registered in March 2018 (€5,899 million).

29% of the backlog is international. In this sense, the contracts obtained in Peru for the conservation of roads in the first quarter stand out, with a volume of €19 million, in Chile (€13 million) and Portugal (€7 million).

Industrial.- The revenue of the Industrial division reached €110 million (-17%) and EBITDA totaled €7 million (-25%). The company has completed large backlog projects, such as Nuevo Mundo and La Pampilla (Peru).

The Industrial backlog reached €2,458 million, up 9% compared to the first quarter of 2018. 11% of which is international.

Sacyr Industrial has signed two BOP contracts for the construction of two 84 MW wind farms in Bio Bio and 155 MW in Antofagasta. Both projects total €61 million.

In addition, the construction of a 5 MW pilot geothermal plant in Laguna Colorada (Bolivia) has been awarded for €15 million.