Sacyr ended the first quarter of 2022 with an EBITDA of €243 million, 25% higher than that in the same period in 2021. Between January to March, profitability (EBITDA margin) made records and situated at 20.3%, 200 basic points higher than that reached a year ago.

These figures are proof of the strength of Sacyr’s business model, which is predictable, recurring, and stable, in a challenging and uncertain macroeconomic scenario. 83% of the EBITDA came from P3 assets with low demand risk.

Revenues grew by 13% in the first quarter of the year, to €1,196 million, and the net business profit raised to €40 million (+57%). The Group’s net result decreased by 21%, to €20 million, due to the fact that the profit last year included the company’s participation in Repsol.

The company’s growth was achieved in a challenging international scenario, due to the Covid-19 and the raw materials shortage and logistics crises.

Net recourse debt went from €681 million to €798 million, largely due to the investments carried out in this period. The commitment for 2022 is to reduce net recourse debt by nearly €200 million, in relation to the figure at the end of 2021.

The company continues to work on cutting net recourse debt, with the aim of having reduced it drastically by the end of the Strategic Plan, in 2025.

Operating cash flow rose to €150 million, with a 28% growth compared to the first quarter of 2021.

Future revenue backlog increases by 5%

Sacyr ended the first quarter with a backlog of €48,343 million, 5% more than in the same period in 2021. 81% of this value comes from Sacyr Concesiones, 13% from Sacyr Engineering and Infrastructures, and the remaining 6%, from Sacyr Services.

The relevant contracts in this period include the Ruta 78 P3 in Chile, the construction of a transportation hub in Northern Ireland, and a section of the US62 road in the United States, as well as several street cleaning services, one of them in Barcelona.

Shareholders’ remuneration

Remuneration to shareholders is one of the cores of the 2021-2025 Strategic Plan. Last February, Sacyr paid a scrip dividend for €0.049 per share, or one share per every 45 existing shares. 85% of the shareholders chose to receive the payment in shares.

At the Annual Shareholders Meeting, held last April 28th, the shareholders approved two new scrip dividends.

Sustainable commitment

Being sustainable in its activities is at the core of all company decisions for Sacyr, and multiple international rating agencies acknowledge so. In the first quarter of 2022, S&P ranked Sacyr among the top 10 most sustainable companies worldwide and included the company in its 2022 Yearbook. Additionally, Carbon Disclosure Project recognized Sacyr as a Supplier Engagement Leader 2021. In this first quarter, Sacyr also issued a social bond for €262 million to finance the Rumichaca-Pasto P3.

Evolution by business divisions

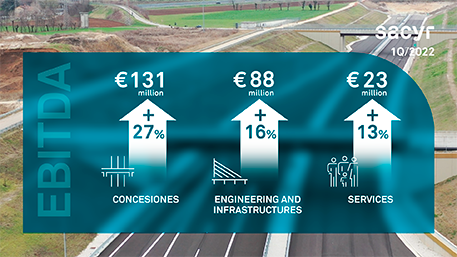

Concessions (P3s).- Sacyr Concesiones obtained revenues of €372 million (+29%) and an EBITDA of €131 million (+27%) thanks to the good performance of P3-derived profits from both infrastructure and water related assets.

This growth was also affected by the commissioning of multiple highway sections and the improvement of traffic, as well as the acquisition of new water assets in Australia and Algeria.

In this first quarter, the company has experienced significant progress on the projects scheduled to be fully operational in 2022. The Pedemontana-Veneta (Italy) is already at 99% progress, Rumichaca-Pasto and Mar 1 in Colombia have reached 98%, while AVO I (Chile) exceeds 97% progress.

The future revenue backlog, which stood at €39,135 million (+7%) includes the Ruta 78 P3 project in Chile, which started running this quarter. This project includes an extension of 133 km, and it will have a positive effect on the lives of close to 1.7 million people.

Engineering and Infrastructures.- Revenues for this division reached €690 million, which is 10% higher than in Q1 2021. The EBITDA grew by 16% to €88 million, and the EBITDA margin rose to 12.7%, compared to 12% last year.

Eliminating the financial asset effect of the Pedemontana project, this division’s EBITDA margin was slightly affected by the extraordinary situation that the sector is experimenting, due to the increase in the cost of raw materials.

This division’s backlog reached €6,090 million, of which approximately 50% comes from the P3 division. The backlog represents 26 months of activity.

Services.- Revenues for this division increased 3% to €250 million. The EBITDA reached €23 million (+13%) and the EBITDA margin stood at 9.4%, above the 8.5% in 2021.

The Services backlog totaled €3,118 million, similar to the same period in 2021.